China’s

lysine price has been facing a huge fluctuation throughout the year 2016, with

the bottom in April and the peak in December. According to market intelligence

firm CCM, the fluctuations are mainly the result of changing corn prices and

new transportation policies.

According

to CCM’s price monitoring, the overall downtrend of lysine price in China in

2016 went on in the beginning of 2016. It then rebounded and were able to rise

till the third quarter of 2016. After another fall of the lysine price by two

months, a huge surge was witnessed in November and December, leading to the

peak of the price at the end of the year. Looking at the overall year on year

change in 2016, China’s lysine price witnessed an overall rise of USD26.32/t,

compared to 2015.

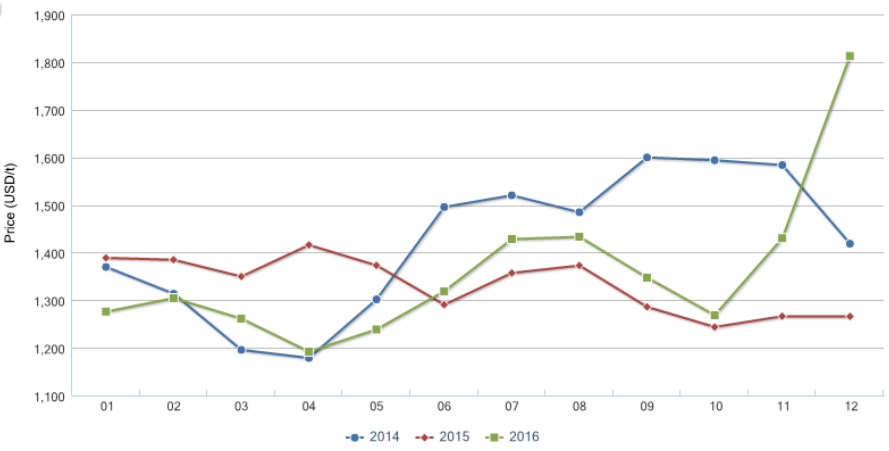

Monthly

market price of 98.5% lysine in China, Jan. 2014-Dec. 2016

Source:

CCM

The

main two reasons for the large fluctuation can be found in the changes of corn

price in China and the intensified transportation pressure.

The

price of lysine is strongly bound to the price development of corn in China,

seen it as the main raw material. So, when the corn price fell in the first

months of 2016, due to huge oversupply, the lysine price was reduced as well. The

rebound in April was then the reaction of tighter supply in the domestic market

before the launch of the national auction for temporarily stored corn.

The

rebound of lysine in November is the result of the winter start in China,

leading to a prioritised transportation of coal for heating instead of food

additives like lysine. Another factor is the new traffic regulations,

implemented in September, which require a lower transportation capacity. These

effects led to a reduced supply and hence surging prices.

However,

in January 2017, the price of lysine decreased again. This trend is mainly due

to lessened transportation costs as a result of relieving strategies for corn

transportation, flat sales during the spring festival in China, and lower

demand for feed, because many farmers sold more animals in the spring festival

time.

The

downturn trend then continued in February as well, as the demand for lysine is

still on a low level. Also, the price peak in December was more an artificially

pushed price by manufacturers in the shadow of corn prices and high

transportation costs, which did not last long as those prices are hard to keep.

Looking

at the exports of lysine ester and salt from China in 2016, a boost of 26.62%,

compared to 2015, can be seen. According to CCM, this trend can be explained by

the low export price of lysine, combined with the continuing depreciated RMB.

Overseas manufacturers have been preferred the cheap food additive from, China

instead of the local ones.

What’s

more, China’s manufacturers witnessed great net profit performances in 2016,

due to the lower production costs. The future looks promising as well, due to

the high lysine price, increasing exports, and the still falling costs of corn

in China. Hence, domestic manufacturers are very likely to continue the great

performance ongoing.

About CCM

CCM is

the leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets.

Do

you want to find out more about the feed market in China? Try our

Newsletters and Industrial Reports or join our professional online platform today

and get insights in Reports, Newsletter, and Market Data at one place.

For

more trade information of lysine, including Import and Export analysis as well

as Manufacturer to Buyer Tracking, contact our experts in trade analysis to

get your answers today.